AI in Loan Underwriting - Speed, Scale, and Smarter Credit Decisions

Himanshu Tiwari

June 13, 2025

In lending, speed and accuracy can make or break the borrower experience — and determine the lender’s risk exposure. As financial institutions face growing pressure to serve diverse, fast-moving markets, traditional underwriting methods are falling behind.

Enter AI-powered loan underwriting.

By combining machine learning, alternative data, and real-time automation, lenders can now accelerate approvals, expand credit access, and improve risk assessment — without compromising on compliance or accuracy.

1. Why Traditional Underwriting Falls Short

For decades, loan decisions have relied on static credit scores and income proofs. While effective in some cases, these methods often:

- Exclude credit-invisible borrowers (gig workers, freelancers, new-to-credit users)

- Involve manual reviews and paperwork that slow down approvals

- Struggle to account for behavioral or real-time data signals

The result? Higher rejection rates, missed opportunities, and borrower frustration — especially in emerging or underbanked markets.

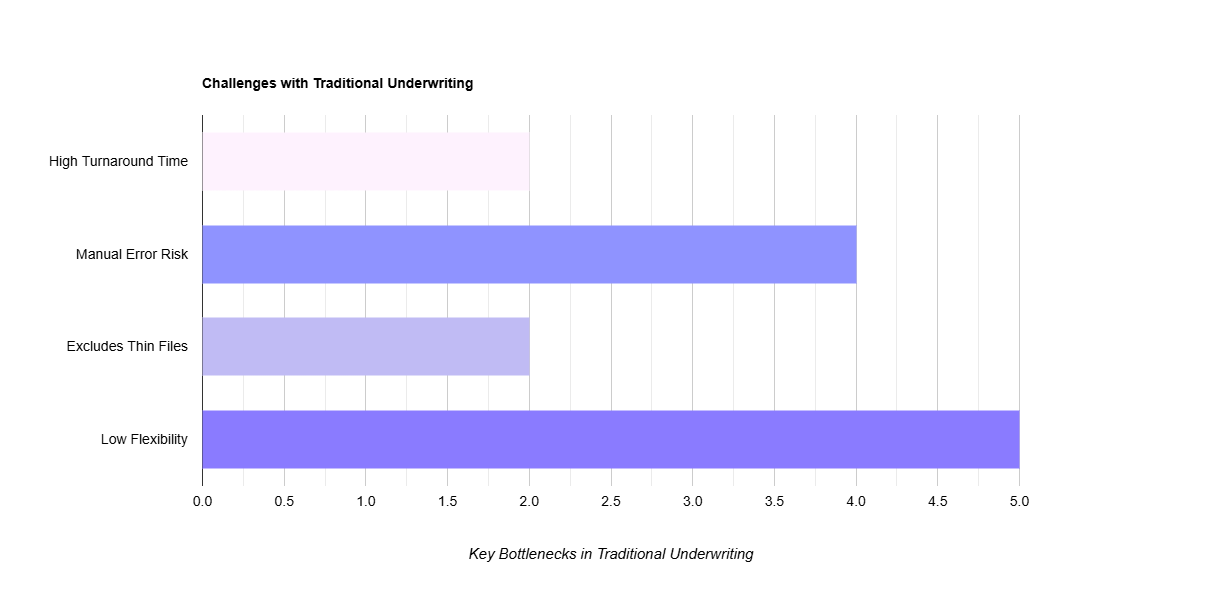

Visual showing: High turnaround time, exclusion of thin file borrowers, manual error risk, low flexibility

Visual showing: High turnaround time, exclusion of thin file borrowers, manual error risk, low flexibility

2. How AI Enhances Underwriting

AI-based models analyze a much broader set of variables — not just credit history — to assess risk and eligibility:

- Banking transaction data

- Mobile and utility payment behavior

- Employment or gig income streams

- Geo-behavioral and device metadata

- Historical loan repayment patterns in peer groups

This enables lenders to:

- Make faster decisions — often in real time

- Score more applicants accurately, especially new-to-credit

- Flag fraud or anomalies early

- Customize offers based on dynamic profiles

3. Impact Across the Lending Ecosystem

Lenders adopting AI in underwriting have reported:

- 60–80% reduction in approval time

- 20–40% uplift in eligible borrower pool

- Lower default rates through better early risk detection

- Improved user satisfaction with faster onboarding

A digital NBFC integrated ML models to underwrite micro-loans under ₹50,000 — reducing their approval time from 3 days to under 20 minutes, while keeping NPA rates flat.

“AI helped us say ‘yes’ to more borrowers — faster — without increasing default risk.”

4. Responsible AI: Balancing Speed with Risk and Ethics

AI in credit decisioning comes with great responsibility. Lenders must ensure:

- Fairness: Avoiding bias against certain demographics or geographies

- Explainability: Being able to justify decisions made by AI models

- Compliance: Meeting local regulatory standards (RBI, FDIC, GDPR, etc.)

- Transparency: Letting borrowers know why they were accepted or rejected

This is where human-in-the-loop (HITL) or rule-based guardrails become essential — combining AI speed with human oversight when necessary.

5. Where AI Fits into Modern Lending Flows

AI underwriting doesn’t replace traditional credit models — it strengthens them.

Common use cases today include:

- Pre-qualification and soft checks

- Tiered risk segmentation for personalized offers

- Instant approvals for repeat borrowers or verified segments

- Real-time fraud detection during onboarding

With tools like weya.ai, you can integrate AI-driven conversational flows to:

- Collect applicant data via chat

- Verify documents

- Connect to scoring engines in real time

6. Final Thoughts

AI is redefining underwriting — not as a black box, but as a smarter lens to assess today’s modern borrowers.

As digital finance evolves, lenders who embrace AI and machine learning will win on both fronts: credit growth and risk resilience.

Ready to bring AI into your lending stack?

weya.ai helps you automate pre-qualification, enrich applications with real-time data, and build onboarding flows that feel both intuitive and trusted.

Book a walkthrough with weya and unlock your next wave of credit innovation.