Chatbots for Loan Customer Support - Transforming Post-Disbursal Experience

Himanshu Tiwari

June 13, 2025

Getting a loan approved is only half the journey. After disbursal, borrowers often need support for repayment schedules, account updates, statements, and payment clarifications.

Traditionally, these queries overload call centers — resulting in delays, higher costs, and frustrated customers.

Today, leading lenders are solving this with AI-powered chatbots — offering 24/7 intelligent support that's fast, scalable, and personal.

Why Loan Customer Support Needs a Rethink

Post-disbursal engagement is critical in the loan lifecycle:

- 64% of borrowers expect instant answers for repayment and balance queries (JD Power, 2024)

- Over 70% prefer self-service over calling support lines

- High call volumes for basic queries limit agent availability for complex cases

Slow or frustrating service directly impacts customer retention, NPS, and refinancing opportunities.

How Chatbots Solve Loan Support Challenges

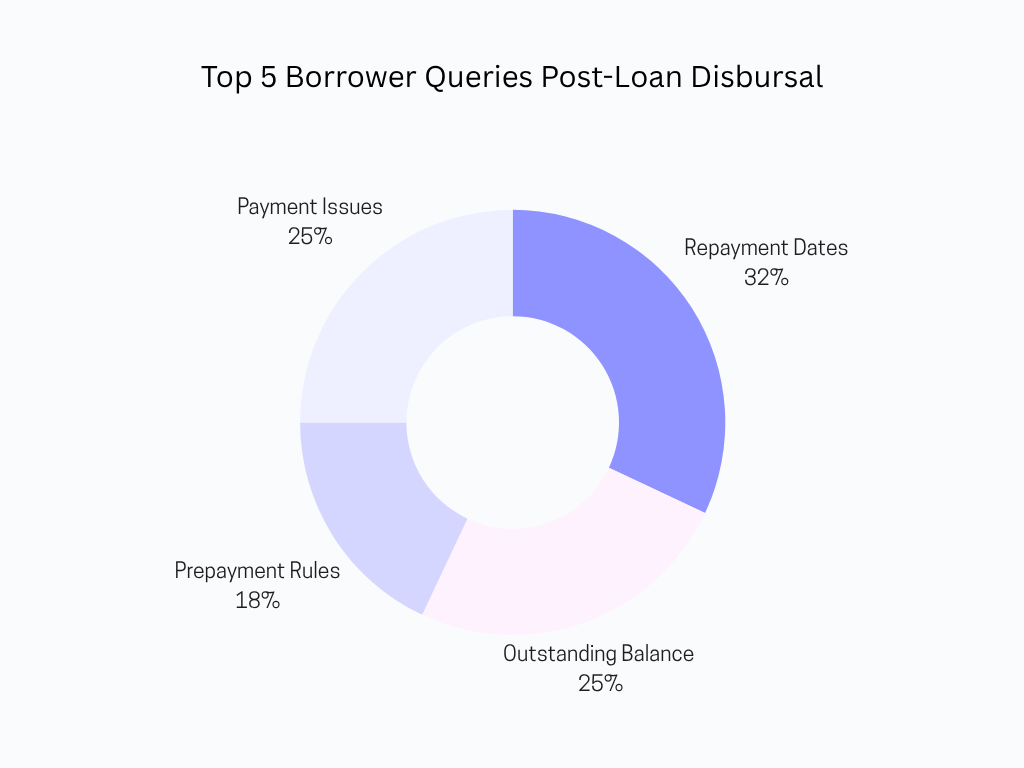

AI chatbots offer instant, conversational assistance for the most common borrower requests:

Repayment Schedule Lookup

Borrowers can ask, “When is my next EMI due?” and receive an instant reply.

Balance and Statement Requests

Chatbots provide outstanding balance or send statements over WhatsApp or email.

Prepayment and Closure Queries

Bots explain foreclosure rules and can generate pre-closure letters automatically.

Payment Assistance

Bots help with EMI reminders, missed payments, or rescheduling requests.

Profile Updates

Borrowers can change contact details or nominee info — securely, without manual intervention.

.png)

Real-World Impact: Faster Support, Happier Customers

Lenders that deployed chatbots for loan support have seen:

- 35–50% reduction in call volumes

- Faster query resolution (under 2 minutes vs. hours)

- 60% of agent time freed for escalations and collections

- Higher borrower satisfaction and EMI recovery rates

“After launching AI support for loans, our borrower NPS jumped by 22 points within one quarter.”

Why weya.ai for Loan Support Automation?

weya.ai helps lenders automate support workflows while staying personal and compliant:

- Multi-language support (English, Hindi, Marathi, and more)

- Available 24/7 across WhatsApp, websites, and mobile apps

- Real-time CRM integrations for accurate info and updates

- Smart escalation rules to connect users with human agents

- Templates for FAQs, repayments, closures, and payment support

Whether it’s a salaried employee checking EMI dates or a business exploring top-up options — weya.ai ensures the experience is seamless, fast, and secure.

Final Thoughts

Borrowers don’t want to wait on hold. They want reliable answers on the channels they use daily.

By using conversational AI, lenders can:

- Improve post-loan engagement

- Reduce support costs

- Boost borrower satisfaction and retention

weya.ai helps automate loan customer support without losing the human touch.

Book a demo with weya and discover how to modernize your borrower servicing.