Digital Lending Assistants - The Future of Borrower Experience in Lending

Himanshu Tiwari

June 13, 2025

Imagine a world where every borrower — from first-time homebuyers to small business owners — has access to a personal loan advisor, available 24/7, fluent in multiple languages, and capable of answering complex financial queries instantly.

That’s not just the future.

It’s being built today with AI-powered digital lending assistants.

As customer expectations rise and competition intensifies, conversational AI is evolving from simple support bots into smart, human-like advisors — guiding users through loan selection, application, and management with ease.

1. Why the Traditional Loan Journey Needs an Upgrade

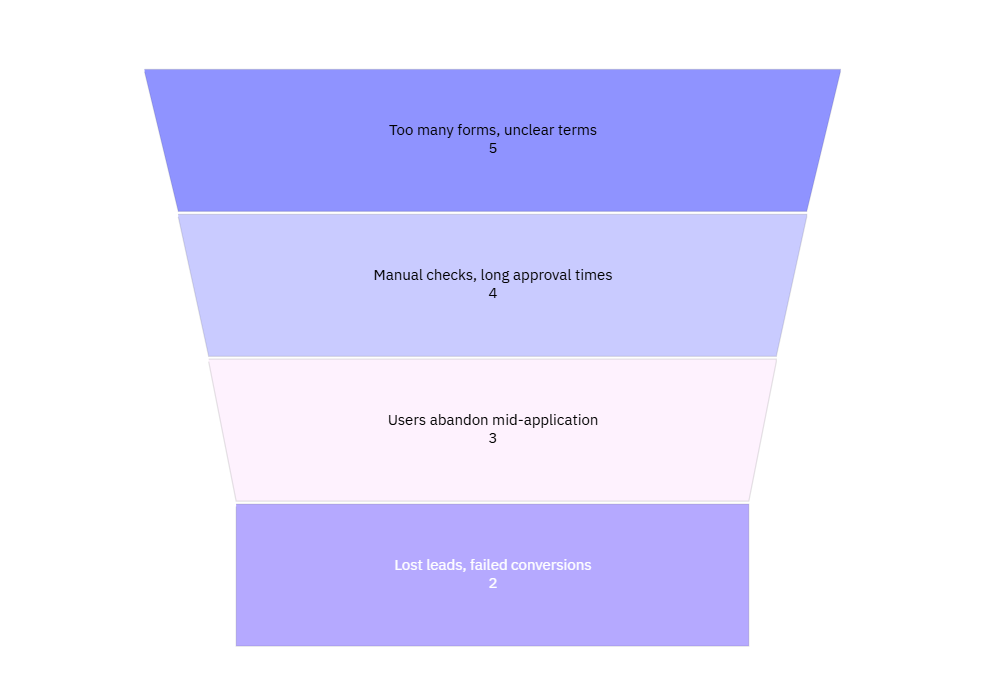

Borrowing money is a high-stakes, often emotional process. Yet in many banks and NBFCs, the borrower experience is:

- Confusing and paperwork-heavy

- Fragmented across multiple channels

- Slow to answer critical questions

- Reactive instead of proactive

This leads to friction, drop-offs, and lost opportunities — especially with digital-first borrowers like millennials, freelancers, and new-to-credit customers.

2. Enter: The Digital Lending Assistant

A digital lending assistant is an AI agent that:

- Helps users understand loan products in simple terms

- Recommends suitable loan options based on user profiles and goals

- Assists with application, KYC, and documentation via chat or voice

- Proactively updates borrowers about approvals, disbursals, and EMIs

- Supports post-loan services like balance checks, prepayment help, and restructuring

And it does all this without long call waits, IVRs, or repetitive questions.

Example:

A user types: “Can I get a home loan if I’m self-employed?”

The assistant instantly reviews eligibility rules, asks for basic info, shares relevant products — and can even schedule a human callback if needed.

.png)

3. Emerging Trends Driving Digital Lending Assistants

- AI model improvements: More contextual, human-like conversations

- Open banking + APIs: Seamless integration with CRMs and scoring tools

- Shift toward advisory CX: Consumers expect brands to guide, not just transact

- Cost pressure: Automating support without ballooning call center costs

According to McKinsey, banks could reduce operational costs by 20–25% by using intelligent assistants in lending by 2026.

4. Benefits for Borrowers and Lenders

For Borrowers:

- Faster, simpler access to loan information

- Personalized guidance throughout the journey

- Higher trust and transparency

For Lenders:

- Increased application completions

- Better-qualified borrowers (less drop-off, better fit)

- Lower operational costs

- Higher cross-sell and up-sell over time

5. How weya.ai Powers the Future of Digital Lending

At weya.ai, we enable banks and lenders to deploy intelligent, multilingual assistants that:

- Guide users through product selection and eligibility checks

- Collect documents and verify identity seamlessly

- Manage loan servicing via WhatsApp, chat, or voice

- Trigger nudges for EMI reminders, renewals, and top-up offers

Whether you’re building a loan discovery assistant, automated onboarding, or a full-stack AI loan advisor — weya’s Flow Canvas makes it fast, scalable, and compliant.

“Our AI assistant turned loan queries into loan applications — without the borrower ever needing to walk into a branch.”

6. Final Thoughts

In 2025 and beyond, the borrower experience will be a key differentiator in lending.

Users will choose brands that educate, assist, and guide — just like a trusted advisor, but smarter, faster, and always on.

The future of lending is conversational, intelligent, and personal.

The future is digital lending assistants.

Want to see how weya.ai can help?

Book a walkthrough today and explore what’s possible.